Calculation of withholding tax Switzerland

The Swiss cantons differ considerably in the way they levy taxes. In some cantons, the tax burden is lower than in others. We explain what you need to look out for if you want to emigrate to Switzerland. A comparison of the tax burden can have a positive effect on your savings rate. It is therefore worth choosing your place of residence in Switzerland carefully from a tax perspective.

Withholding tax - Emigration Switzerland

What exactly is withholding tax? Do you have to complete a tax return in Switzerland? And where is withholding tax lowest? The experts at Deine3a will provide you with competent advice on tax issues and other important points relating to emigrating to Switzerland.

Withholding tax - Emigration Switzerland

You can save taxes if you choose a tax-favourable canton of residence 😉 This is because the tax rate is generally determined by the place of residence rather than the place of work. This applies to both normal taxes and withholding tax.

Note: The proportion of wealthy people is high in low-tax cantons, and rents and property prices there can be astronomical. Therefore, make sure that you take all aspects into account when deciding which canton to live in.

Emigrants who have a B residence permit and work in Switzerland are subject to withholding tax. This means that your withholding tax is deducted directly from your salary. Holders of a C permit, on the other hand, must complete their own annual tax return and declare their income in it.

When do I have to complete the Swiss tax return?

- as soon as you receive the permanent C residence permit

- earn more than CHF 120,000 gross income per year

- you have a spouse with a Swiss passport or C permit

- you in Switzerland Real estate owns.

Tax return for Germans in Switzerland 🇨🇭

For many people, the annual tax return is tedious and time-consuming. For expats living in a new country such as Switzerland, the tax return - if one has to be completed - can lead to confusion. This is because for most people the tax issue is complex.

In general, it can be said that Germans pay comparatively less tax in Switzerland and are therefore allowed to keep a larger proportion of their salary than in Germany.

Tax terms

👉 Get in touch for a free consultation: Contact

👉 Budget calculator - How much will Switzerland cost me? Budget calculator

👉 Ready to emigrate? Get the Switzerland checklist: Checklist

👉 You can find more topics relating to your emigration here: Topic overview

👉 Subscribe to our YouTube channel: YouTube

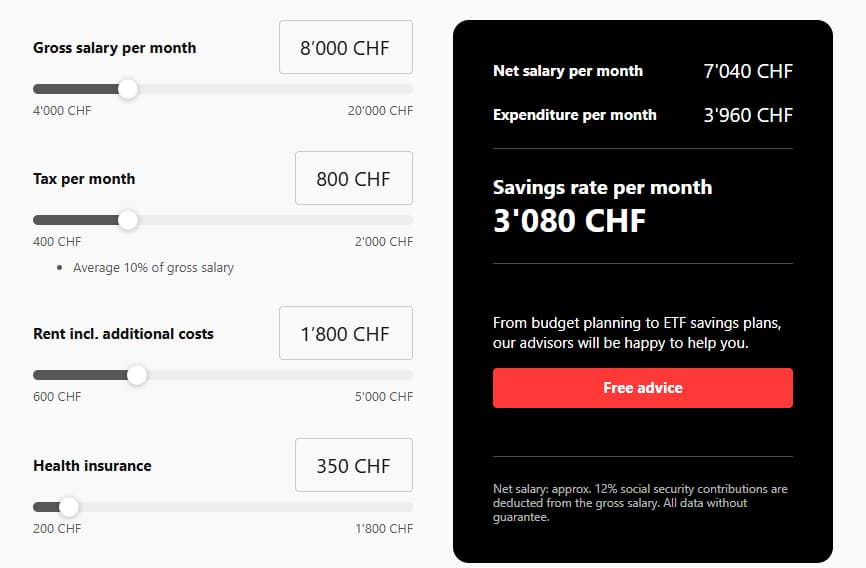

Budget calculator - How much will Switzerland cost me per month?

Emigrating to Switzerland: With our budget calculator, you can realistically estimate your monthly expenses in Switzerland. From rent to health insurance to taxes - the tool calculates your living costs and shows you your savings rate at the end. Ideal for preparing for your emigration to Switzerland.

Counselling team

Our advisory team and office staff specialise in emigrants from Germany and Austria, and we help people emigrate to Switzerland every day. If you would also like to emigrate to Switzerland, please get in touch using the contact form and get to know our team in Zurich - we look forward to hearing from you! 🤗

Do you have any questions?

You want to emigrate to Switzerland? We are here for you. Our consultations are free of charge. You can reach us via the contact form or drop by for a coffee in Zurich.

- Home page

- Your3a | Calculating withholding tax Switzerland | Emigration Switzerland | Emigration agency