Tax system in Switzerland

If you want to emigrate to Switzerland, you should understand the tax system early on - because it differs significantly from the German model. We explain how taxes work in Switzerland and give you a clear overview of the most important types of tax. You will learn how national, cantonal and communal taxes interact and what you should pay attention to in order to make the most of tax advantages when emigrating to Switzerland.

Tax collection on three levels

1st collar

The federal government levies certain taxes that are the same throughout Switzerland, e.g. direct federal tax and VAT (which will be 8.1 per cent in 2024).

2nd canton

Each of the 26 cantons has its own tax system. The cantons have the right to set their own taxes, which means that the tax burden varies from canton to canton. The cantons of Zug, Nidwalden and Schwyz, for example, are considered to be particularly tax-favourable. However, this is often reflected in high rents and property prices.

3rd municipality

The municipalities also levy taxes, and the amount of these taxes also varies depending on where you live.

The most important types of tax in Switzerland

Income tax

Income tax is the tax on your income, similar to Germany. However, in Switzerland it is not only levied at federal level, but also at cantonal and communal level. The tax burden can vary depending on the canton and municipality.

State and municipal tax

Firstly, it should be mentioned that the terms state tax and cantonal tax mean the same thing: taxes levied at cantonal level, as "state" in Switzerland often stands for the cantons.

State and municipal taxes are the taxes you pay in your canton and municipality. These taxes are levied on your income and assets and make up a significant part of your tax burden. The tax rates vary greatly from canton to canton and from municipality to municipality.

Tax rate: An important concept in the Swiss tax system is the tax rate. This is the factor used to calculate the tax burden in a municipality or canton. It is given as a percentage and influences how high your municipal tax will be. A lower tax rate means a lower tax burden.

Direct federal tax

Direct federal tax is levied at federal level and also affects your income. However, it is calculated separately from cantonal and communal tax and is added on top.

Property tax

Unlike in some other countries, in Switzerland not only your income but also your assets are taxed. This includes your cash assets, property and share portfolios. Wealth tax is levied at cantonal and communal level. To put it mildly, wealth tax is a small tax that carries little weight. For example, if you have assets of CHF 500,000 (city of Zurich, single person), you would pay less than CHF 700 per year in wealth tax.

Withholding tax

Withholding tax is relevant for B-permit holders, for example, and is deducted directly from the salary and covers income and wealth tax. The amount of withholding tax varies depending on the canton, income and marital status. As soon as you receive a C residence permit, you will be taxed in the "normal" way - in other words, you will be required to complete an ordinary Swiss tax return every year at the latest.

Profit and capital tax

Companies in Switzerland pay profit tax and capital tax. Profit tax relates to the profit that a company makes, while capital tax taxes the company's equity.

Value added tax

Value added tax (VAT) is relatively low in Switzerland compared to other European countries. It is levied on goods and services and corresponds to the German sales tax.

Withholding tax

Withholding tax is levied on interest, dividends and lottery winnings. This tax serves to prevent tax evasion, as it is only refunded if you declare this income in your tax return.

Church tax

If you are a member of one of the recognised churches in Switzerland, e.g. the Catholic or Reformed Church, you must pay church tax. This is calculated together with your income tax and forwarded to the church.

Online tax calculator

Emigrating to Switzerland: The online tax calculators provided by many cantons are a useful tool for calculating your tax burden. A good example is the tax calculator of the canton of Zurich. There you can enter your income, your assets and your place of residence to find out how much tax you have to pay.

Important to know: The cantonal tax calculator generally only takes cantonal and communal taxes into account. To determine your total tax burden, you must add the direct federal tax. This will give you a complete overview of your tax obligations.

The Swiss tax system may seem complicated at first glance, but with the right information and tools it is easy to navigate. The tax burden can vary greatly depending on the canton and municipality, and it's worth finding out early on and using the tax calculator to avoid surprises. For further questions or detailed advice, our experts at Deine3a will be happy to assist you - contact us for personalised tax advice and planning.

👉 Get in touch for a free consultation: Contact

👉 Budget calculator - How much will Switzerland cost me? Budget calculator

👉 Ready to emigrate? Get the Switzerland checklist: Checklist

👉 You can find more topics relating to your emigration here: Topic overview

👉 Subscribe to our YouTube channel: YouTube

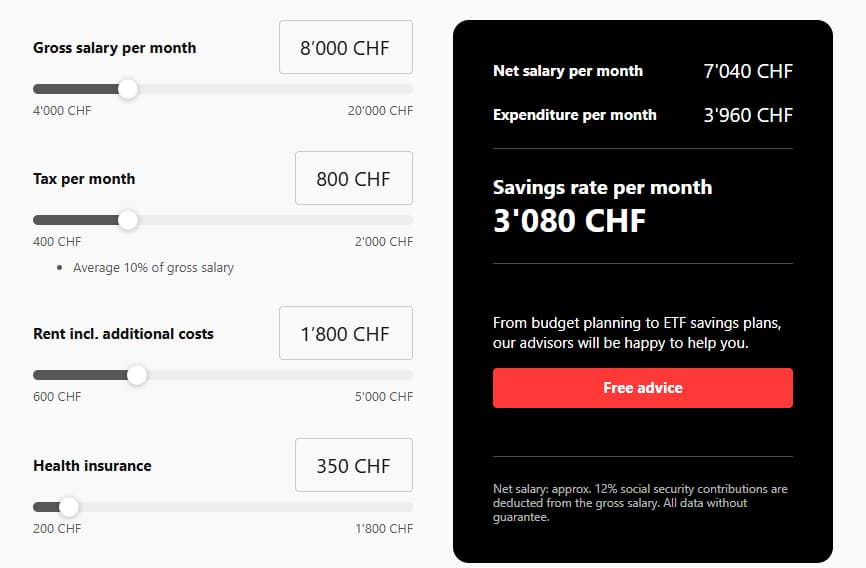

Budget calculator - How much will Switzerland cost me per month?

Emigrating to Switzerland: With our budget calculator, you can realistically estimate your monthly expenses in Switzerland. From rent to health insurance to taxes - the tool calculates your living costs and shows you your savings rate at the end. Ideal for preparing for your emigration to Switzerland.

Counselling team

Our advisory team and office staff specialise in emigrants from Germany and Austria, and we help people emigrate to Switzerland every day. If you would also like to emigrate to Switzerland, please get in touch using the contact form and get to know our team in Zurich - we look forward to hearing from you! 🤗

Do you have any questions?

You want to emigrate to Switzerland? We are here for you. Our consultations are free of charge. You can reach us via the contact form or drop by for a coffee in Zurich.

- Home page

- Your3a | Tax system in Switzerland | Emigration Switzerland | Emigration agency