Health insurance for emigrants

Basic insurance is compulsory, while supplementary insurance can be taken out voluntarily. We explain what a sensible combination of the two can look like. If you want to emigrate to Switzerland, you are often faced with the question of which Swiss health insurance is really right for you. We'll show you what you need to look out for when choosing health insurance, benefits, cover and premiums in order to avoid costly mistakes right from the start.

How health insurance works in Switzerland

As soon as you are resident in Switzerland, you have three months to take out health insurance. Important: The start of insurance is always the date of entry/arrival (obligation to pay contributions).

In contrast to Germany, you are responsible for your own health insurance in Switzerland. You are free to choose your own health insurance provider.

Swiss health insurance consists of three parts:

- Basic insurance

- Supplementary outpatient insurance

- Supplementary inpatient hospital insurance

The benefits covered by basic insurance are identical for all health insurers and include illness, accident and maternity.

However, the monthly premiums to be paid vary and are calculated on the basis of various factors. The amount of the premium depends on where you live (postcode), your age, the insurance model you have chosen and your deductible (amount of the excess).

You want to go to the Emigrate to Switzerland? Register early for a free emigration consultation and we will be happy to help you.

Basic insurance

Swiss health insurance premiums generally rise every year and can become a high cost factor if you don't find out about optimisation options in advance. Example: the telemedicine model is often cheaper than other models.

You can change your basic insurance every year. Important: Your letter of cancellation must be received by your health insurance company as a registered letter by the last working day in November at the latest. The change will take place on 1 January.

Incidentally, Swiss health insurance companies are obliged to accept every person, regardless of age and state of health, into their basic insurance. However, the situation is different for supplementary insurance: each health insurance company decides individually whether to accept or reject a customer. If you would like to emigrate to Switzerland, we will help you to go through and answer all the health questions relating to supplementary insurance together.

Costs

- Age

- Place of residence (postcode): premiums are higher in the city than in the country

- Deductible (excess)

- Insurance model (e.g. telemedicine)

What about accident cover?

If you work more than 8 hours a week for the same employer, you are automatically insured against "accidents" by your employer. Accident insurance covers both occupational and non-occupational accidents. If you are self-employed or not employed, you must insure yourself against accidents with your health insurance company (or private accident insurance).

Franchise: what exactly is it?

In Switzerland, you have two types of excess: Firstly, the deductible and then the excess of 10% (up to a maximum of CHF 700 for adults).

The deductible is prescribed by law. The amount ranges from CHF 300 to CHF 2500, the maximum authorised deductible. Only once you have paid the deductible yourself will further costs be covered by your health insurance.

Important to know: If you are healthy and choose a higher deductible (CHF 2,500 is recommended), you will benefit from lower monthly premiums. However, a low deductible (and therefore high monthly premiums) is generally only worthwhile for people who regularly have high healthcare costs (e.g. if you are regularly dependent on expensive medication).

As soon as your healthcare costs have reached the amount of the deductible (e.g. CHF 2500), a further deductible of 10% (up to a maximum of CHF 700) applies.

Example 1

Deductible CHF 2,500 and medical bills totalling CHF 2,200

= you pay everything yourself and have a remaining deductible of CHF 300

Example 2

Deductible CHF 2,500 and medical bills totalling CHF 3,300

You pay CHF 2500 plus 10% deductible for CHF 800 = CHF 80

= the health insurance company will reimburse you Fr. 720 (Fr. 3300 - Fr. 2580)

Free visits to the doctor in Germany

When emigrating to Switzerland, many people ask themselves: Can I continue to go to my trusted doctor in Germany or Austria? The answer is yes - if you have taken out the right insurance.

Thanks to our wide range of products, we can insure expatriates so that they can continue to see doctors in Germany. If treatment is planned in Germany, the deductible is waived and you may be able to save money.

Furthermore, unlike in Germany, no supplementary dental insurance is included in Swiss basic insurance. Dental treatment is therefore not covered by Swiss health insurance. We can offer you supplementary dental insurance on request. Important: you must take out supplementary dental insurance before moving to Switzerland in order for it to remain valid. You should therefore contact us in good time for a consultation if you wish to emigrate to Switzerland.

Exemption from Swiss health insurance

Anyone who works in Switzerland is required by law to have basic health insurance. There are ways to be exempted from compulsory health insurance in Switzerland. Are you moving to Switzerland soon? We will be happy to advise you on which requirements must be met in order to be exempted (e.g. students).

What else is important besides health insurance?

As soon as you start your new life in Switzerland, you will realise that the Swiss attach great importance to good insurance cover. Below you will find a selection of insurances that we consider important if you want to emigrate to Switzerland. You can study these before you move to Switzerland. We at Deine3a recommend these insurances because they protect you from financial consequences in the event of a claim, otherwise you could end up in a financial bottleneck.

Household contents insurance

Emigration Switzerland: This insurance protects your possessions (e.g. laptop) within your own four walls against damage caused by theft, fire, water and other unforeseen events. In Switzerland, household contents insurance is part of the basic cover, meaning that almost everyone in this country has such insurance. You can also insure your bicycle or e-bike with us. And if you wear an expensive watch or own jewellery, you can take out valuables insurance.

Personal liability insurance

This is essential to protect you against possible claims for damages by third parties. The insurance covers financial obligations if you accidentally damage the property of others or cause physical harm to someone. This also includes tenant damage. The landlord could make a claim at the latest when you move out of the flat. If you do not have personal liability insurance, you will have to bear the financial consequences yourself. At Deine3a, we recommend that you ideally take out personal liability and household contents insurance before moving into your new home so that you are insured from day 1 in your new home. This way, you can emigrate stress-free and furnish your new home in Switzerland without any worries.

Legal expenses insurance

This insurance covers the costs of legal disputes, for example in the area of labour law, tenancy law or road traffic disputes. This insurance offers you financial protection and gives you access to legal assistance. In most cases, it costs no more than CHF 250 to 390 per year - roughly equivalent to the hourly rate of a Swiss lawyer. As you can see, the savings potential is enormous.

👉 Get in touch for a free consultation: Contact

👉 Budget calculator - How much will Switzerland cost me? Budget calculator

👉 Ready to emigrate? Get the Switzerland checklist: Checklist

👉 You can find more topics relating to your emigration here: Topic overview

👉 Subscribe to our YouTube channel: YouTube

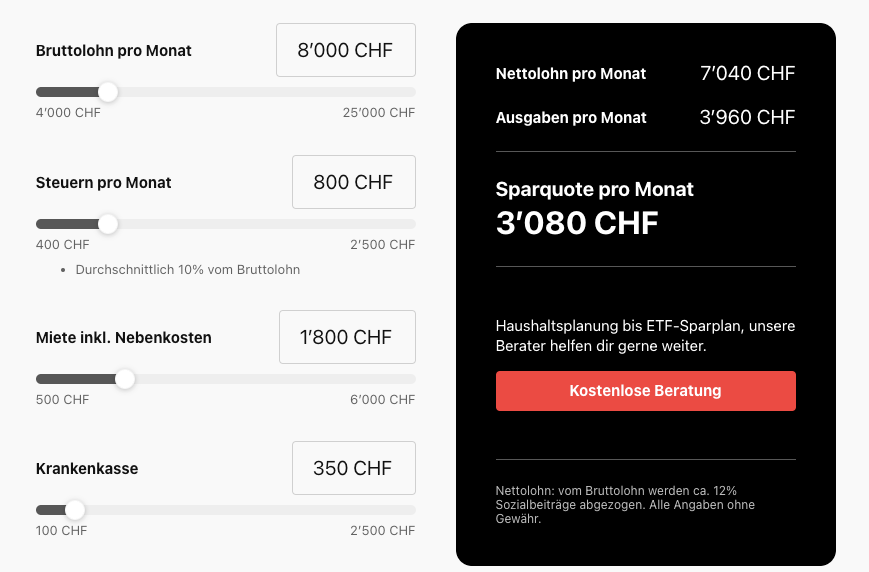

Budget calculator - How much will Switzerland cost me per month?

Emigrating to Switzerland: With our budget calculator, you can realistically estimate your monthly expenses in Switzerland. From rent to health insurance to taxes - the tool calculates your living costs and shows you your savings rate at the end. Ideal for preparing for your emigration to Switzerland.

Counselling team

Our advisory team and office staff specialise in emigrants from Germany and Austria, and we help people emigrate to Switzerland every day. If you would also like to emigrate to Switzerland, please get in touch using the contact form and get to know our team in Zurich - we look forward to hearing from you! 🤗

Do you have any questions?

You want to emigrate to Switzerland? We are here for you. Our consultations are free of charge. You can reach us via the contact form or drop by for a coffee in Zurich.

- Home page

- Deine3a | Health insurance for emigrants | Emigration Switzerland | Emigration agency