Pension provision in Switzerland

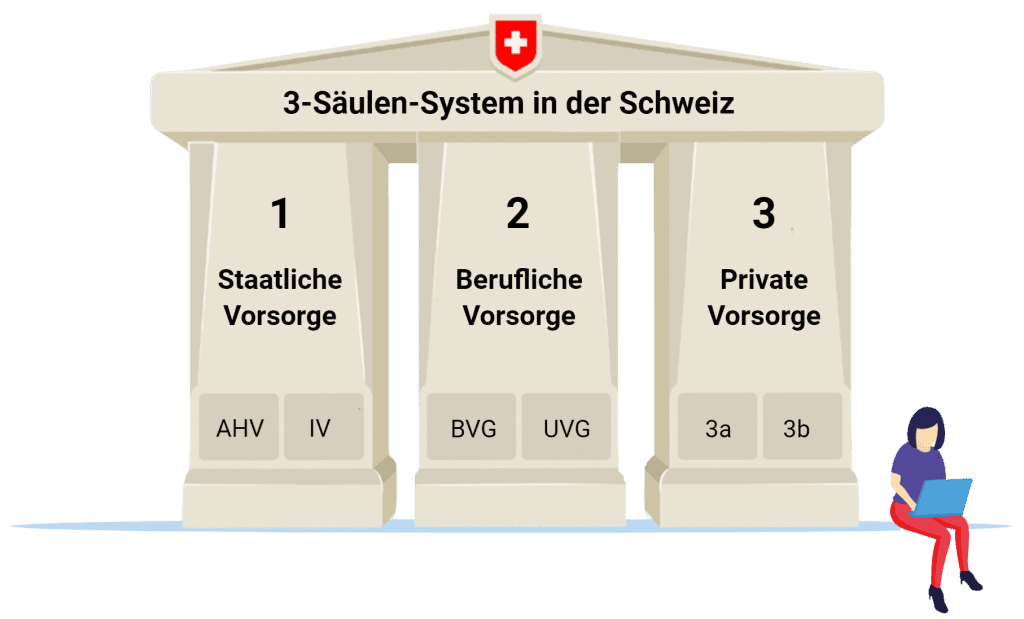

Emigrating to Switzerland: Pension provision is a key issue when settling in a new country like Switzerland. That's why it's important to find out what options are available to you before you emigrate. Anyone planning to emigrate to Switzerland should be familiar with the three-pillar system and clarify in good time how existing entitlements can be integrated.

Pillar 1

Pillar 1 is the state pension scheme. It includes AHV and IV and forms the minimum basis of existence.

Pillar 2

The 2nd pillar is occupational benefits insurance. This includes the pension fund and accident insurance.

3rd pillar

Pillar 3 is your private pension provision and is divided into 3a and 3b. The tax advantage of pillar 3a is worth mentioning.

The golden years - Emigration Switzerland

Many emigrants dream of spending their golden years in Switzerland. It is advisable to consider retirement provision in Switzerland before you move. With its three-pillar system, Switzerland offers a stable basis for financial security in old age. Find out in good time so that you can one day enjoy a carefree retirement 😊

The Swiss 3-pillar system - simply explained

Pillar 1

The 1st pillar secures your livelihood in old age and must be paid in by everyone in Switzerland. The corresponding contribution is deducted directly from your salary and includes Old-age and survivors' insurance (AHV), disability insurance (IV) and any supplementary benefits (EL).

Pillar 2

The 2nd pillar is known as the «BVG» (statutory minimum requirement) or under the term «Pension fund» (additional benefits included) are known. Anyone with a minimum annual salary of CHF 22,050 per year is compulsorily enrolled in the pension fund. Both the employee and the employer pay contributions.

The 2nd pillar - as a supplement to the 1st pillar - covers the cost of living in retirement. This contribution is also deducted from your salary (7 to 18 per cent, depending on age).

If an expatriate comes to Switzerland at the age of 40, he or she will have a considerable gap in the 1st pillar and also in the 2nd pillar. Against this background, it is essential - if you want to continue living in Switzerland as a pensioner - to make private provisions, i.e. pillar 3a savings. After all, the pensions from Germany that you have saved up to the age of 40 will hardly be enough to finance the cost of living in Switzerland.

3rd pillar

In the 3rd pillar, a distinction is made between the Pillar 3a (tied pension provision) and pillar 3b (unrestricted pension provision). With the 3rd pillar, you can ideally ensure that you can maintain your accustomed standard of living in retirement.

The tax advantage of pillar 3a should be emphasised in particular: contributions paid in up to a maximum of CHF 7,056 can be deducted from taxable income.

The most important insurance products at a glance

Growing old happily in Switzerland - that's rightly a wonderful prospect! 😇 But what should you look out for so that you can enjoy the best possible quality of life in old age? Here we present the Swiss pension system.

This is based on the well-known 3-pillar system, which gives you the opportunity to make both state and private provisions for old age. However, there is also a wide range of supplementary products, from pillar 3a and 3b to life insurance and important concepts such as lump-sum death benefits, premium waivers and disability pensions. Let's take a closer look.

Pillar 3a and pillar 3b

The third pillar, and therefore your private pension provision, is divided into two categories: restricted pension provision (pillar 3a) and unrestricted pension provision (pillar 3b). So far, so familiar.

Pillar 3a is tax-incentivised and offers you the opportunity to deduct a certain amount (for 2024: CHF 7,056 for employees) from your taxes each year. In return, however, your capital is subject to certain conditions. As a rule, you can withdraw it five years before normal retirement at the earliest. An early withdrawal is only possible in a few exceptions, e.g. for the purchase of residential property or for starting a self-employed activity.

Pillar 3b is the so-called "free pension plan". Here you have no tax advantages, but maximum flexibility. You can pay in and withdraw as much as you like at any time without being bound by strict requirements. It is particularly suitable for short-term or medium-term savings goals and as a supplement to pillar 3a.

Emigration Switzerland works smoothly with our help, sign up for a free pension consultation.

Life insurance

- Term life insuranceThis form of insurance only covers the risk of death. If you die during the insurance period, an agreed sum is paid out to your surviving dependants. There is no savings component here, it is primarily about securing the standard of living of the beneficiaries of the insurance.

- Endowment insuranceThis combines death cover with a savings investment. You therefore pay regular premiums, which flow into the insurance cover on the one hand and are used to build up capital for your old age on the other.

Lump-sum death benefit

The term lump-sum death benefit may sound uninviting, but it is an important part of your pension provision. It ensures that your surviving dependants are financially secure in the event of your death.

- Single productYou can take out the lump-sum death benefit separately as an independent insurance policy if you wish. This can be particularly useful if you do not want to take out a complex life insurance policy but still want to ensure that your family is financially provided for after your death. In this case, the insurance company pays out the agreed sum directly to the beneficiaries.

- Integrated into life insuranceLump-sum death benefit is often integrated into an endowment policy. This means that in the event of death, the insurance company pays out either the amount saved or an agreed sum - whichever is higher. This makes this product particularly attractive for those who want to combine both retirement provision and death cover.

- A major advantage of insurance compared to banking products is the Premium exemption. If you become unable to work due to illness or accident, the insurance will cover your premium payments. This means that your pension provision will continue even if you are temporarily or permanently unable to work and pay premiums yourself.

Disability pension

The Disability pension is one of the most important forms of protection of all. Because should it happen (and we'll keep our fingers crossed that it doesn't) that you are no longer able to work, this pension will provide you with an income that you can use to maintain your standard of living. Young people in particular often underestimate the relevance of the disability pension, even though the financial obligations are usually the highest in the early stages of working life. It is therefore advisable to plan this protection into your pension early on so that you are not dependent on state support, which often only provides basic security, in the event of an emergency.

The tax advantage of pillar 3a should be emphasised in particular: contributions paid in up to a maximum of CHF 7,056 can be deducted from taxable income.

The compound interest effect: saving early pays off

One of the biggest advantages of pillar 3a is the Compound interest effect. The earlier you start saving, the more you will benefit from the fact that your interest will also earn interest again. If you start just five years later, you may end up having to accept significant losses. It is therefore crucial to start saving as early as possible. Every month counts, as the compound interest effect increases the impact of your contributions over the years. The capital saved grows and increases over time - a good thing from which you should maximise your benefits!

At Deine3a, we know exactly how to get the best out of your pension provision. We know the Tricks and tips (and yes, there really are a lot of them) that you can use to get your pension up to scratch and maximise your returns. So whether it's about choosing the right products, tax advantages or the optimal investment strategy - we're here for you. Contact us and we will help you to optimise your pension provision and create a comfortable financial cushion for your retirement!

Comparison of the German or Austrian pension with the Swiss pension

Germans and Austrians who emigrate to Switzerland to work or live here permanently quickly realise that the Pension or retirement provision works differently here than at home. In Germany and Austria, pensions are based almost exclusively on the pay-as-you-go system. This means that current pension payments are financed by the contributions of the working generation. Demographic change - fewer and fewer young people are financing more and more pensioners - creates long-term uncertainties and often lower pensions than hoped for.

In Switzerland, the pension system is more stable and transparent. It is based on the 3-pillar principle:

The 1st pillar (AHV) provides for basic security in old age, which Pillar 2 (occupational benefit scheme) builds up its own pension account through funded contributions, and the 3rd pillar (private pension provision) makes it possible to make additional individual provisions and save taxes at the same time. For emigrants, this means that reliable pension entitlements are created from the very first job in Switzerland, and those who take out additional private insurance can plan their retirement much more flexibly.

So if you are a German or Austrian planning to move to Switzerland or work here, the pension system is a great advantage. The combination of basic state provision, occupational pension provision and private provision makes retirement provision predictable and robust. If you make clever provisions, you have much better opportunities to organise your own pension later on, a prospect that is much more difficult to achieve in this form in Germany or Austria.

7 tips for emigrating to Switzerland - How to do it right!

- 3rd pillar: Payout possible on emigration - check taxes.

- Withholding tax: Varies depending on the canton - check in advance.

- Double taxation: Clarify with new country of residence.

- AlternativesLump-sum withdrawal or pension model? Long-term planning is important.

- Deadlines & Forms: Take care in good time, otherwise there is a risk of penalties or losses.

- Use counsellingConsult tax and pension experts for customised solutions - we can help you.

- Check tax differencesSome countries tax pension income more heavily.

👉 Get in touch for a free consultation: Contact

👉 Budget calculator - How much will Switzerland cost me? Budget calculator

👉 Ready to emigrate? Get the Switzerland checklist: Checklist

👉 You can find more topics relating to your emigration here: Topic overview

👉 Subscribe to our YouTube channel: YouTube

Counselling team

Our advisory team and office staff specialise in emigrants from Germany and Austria, and we help people emigrate to Switzerland every day. If you would also like to emigrate to Switzerland, please get in touch using the contact form and get to know our team in Zurich - we look forward to hearing from you! 🤗

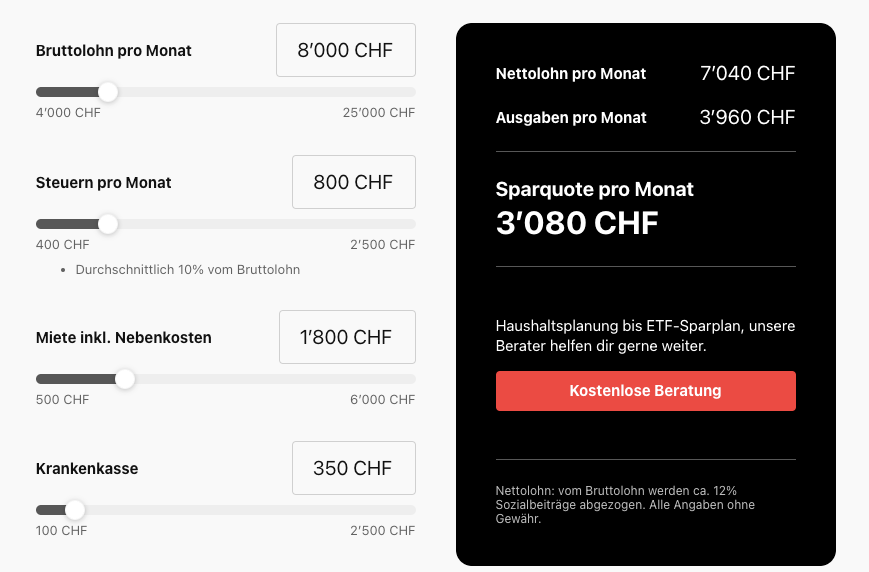

Budget calculator - How much will Switzerland cost me per month?

Emigrating to Switzerland: With our budget calculator, you can realistically estimate your monthly expenses in Switzerland. From rent to health insurance to taxes - the tool calculates your living costs and shows you your savings rate at the end. Ideal for preparing for your emigration to Switzerland.

Do you have any questions?

You want to emigrate to Switzerland? We are here for you. Our consultations are free of charge. You can reach us via the contact form or drop by for a coffee in Zurich.

- Home page

- Deine3a | Retirement provision for emigrants | Emigration Switzerland | Emigration agency