Share portfolio transferred from Germany to Switzerland

Are you planning to emigrate to Switzerland and would like to transfer your ETF and share portfolio from Germany to Switzerland? With the right steps, you can easily transfer your portfolio, overcome tax hurdles and keep your finances under control even after the move.

Your share portfolio in Germany

For many Germans, moving to Switzerland is a big step that not only offers new life prospects, but can also bring considerable tax advantages for investors. Anyone who wants to emigrate and Equity or ETF portfolio in Germany should clarify the tax consequences at an early stage. While in Germany capital gains such as Dividends and capital gains high taxes, capital gains can remain tax-free for private individuals in Switzerland. A carefully planned custody account transfer can therefore make a considerable difference and make the move to Switzerland particularly attractive for investors. If you check your custody account in good time and transfer it correctly, you can effectively save taxes in this way.

Capital gains tax in Germany

In Germany, investment income such as dividends and realised capital gains are taxed at 25% Withholding tax plus solidarity surcharge and, if applicable, church tax. This tax liability applies as long as your tax residence is in Germany. If you move to Switzerland, you should plan your departure carefully and deregister with the tax office in good time in order to avoid unnecessary tax liability. Double taxation to avoid this. It also makes sense to check existing exemption orders and investment options such as the non-assessment certificate in order to optimise the tax burden until the move. If you follow these steps, you can organise the custody account transfer in a tax-compliant manner and make your start in Switzerland more efficient.

Emigrating to Switzerland - New tax residence in Switzerland

A move to Switzerland offers investors considerable tax advantages, especially for equity and ETF portfolios. From the moment you become a tax resident in Switzerland, future capital gains are subject to Swiss regulations. Capital gains on shares and ETFs are generally tax-free for private individuals in Switzerland. tax-free, while dividends are subject to Swiss withholding tax, which is credited against income tax. Germany does not levy an exit tax on private share gains, which means that unrealised capital gains already in the securities account are generally not taxed retroactively upon relocation. Only gains realised before the move are still subject to German tax.

A Planned securities account transfer is therefore crucial in order to avoid unnecessary tax charges. Banks in Germany and Switzerland have different regulations, and early coordination makes the transfer easier. Those who report the change of residence to the tax authorities in good time and observe the tax framework can optimally benefit from the tax advantages of Switzerland. In addition to tax aspects, Switzerland offers investors a stable financial system, a high degree of legal certainty and transparent regulations, which makes the move particularly attractive for investors.

Double taxation agreements (DTA)

Capital gains on securities that are realised in Switzerland after the change of residence are generally only subject to Swiss taxation, while Germany is no longer entitled to these gains. Those who are familiar with the provisions of the DTA can make targeted plans. Careful coordination with the tax authorities in both countries ensures that the advantages of the double taxation agreement are utilised to the full and that no double taxation arises.

The double taxation agreement between Germany and Switzerland also stipulates which country is authorised to tax which income in the case of dividends. After moving to Switzerland, dividends from German companies are initially withheld in Germany as the source country at a reduced tax rate. This withholding tax deduction can often be offset against the tax due in Switzerland so that no double tax has to be paid.

Portfolio transfer to Switzerland

Switching your custody account to a Swiss Broker can bring tax advantages for anyone wishing to emigrate to Switzerland. Capital gains, Income realised after the change of residence is generally tax-free for private individuals in Switzerland. When transferring a custody account, in many cases you can leave the existing share and ETF positions in Germany and transfer them directly to a Swiss broker without having to sell the shares or ETFs. This usually incurs transaction costs and it is important to plan the transfer with both banks at an early stage to ensure a smooth process and clarify any tax issues. A direct Depot transfer makes it possible to leave previously realised capital gains in Germany untouched and at the same time benefit from the tax advantages of Switzerland. Before moving, investors should check whether the Swiss broker can accept all securities and what fees are incurred for the transfer.

Capital gains tax in Switzerland

In Switzerland, private sales of securities are generally exempt from capital gains tax, meaning that price gains on shares and ETFs for private individuals are not subject to capital gains tax. tax-free remain. Dividends and interest, on the other hand, count as taxable income and are taxed at the progressive income tax rate of the respective canton of residence. This makes Switzerland particularly attractive for investors who want to invest in securities for the long term and benefit from the tax exemption on capital gains.

Legal notice: This article is for general guidance. For individual planning, you should always seek expert tax and legal advice in order to optimally consider all aspects of your move and portfolio transfer. All information is provided without guarantee, liability is excluded.

7 tips for emigrating to Switzerland - How to do it right!

- Depot transfer: Usually free of charge, but not always. Check!

- Taxes: In Germany withholding tax, in Switzerland wealth tax.

- Exchange rates: Convert euros into francs? Note the costs.

- Tax certificate: Save important documents for your tax return.

- Mandatory reporting: Declare investment income correctly in both countries.

- Deadlines: Transfer can take a while - plan in good time.

- Deposit structure: Direct transfer or sale and new purchase? Consider the tax consequences.

👉 Get in touch for a free consultation: Contact

👉 Budget calculator - How much will Switzerland cost me? Budget calculator

👉 Ready to emigrate? Get the Switzerland checklist: Checklist

👉 You can find more topics relating to your emigration here: Topic overview

👉 Subscribe to our YouTube channel: YouTube

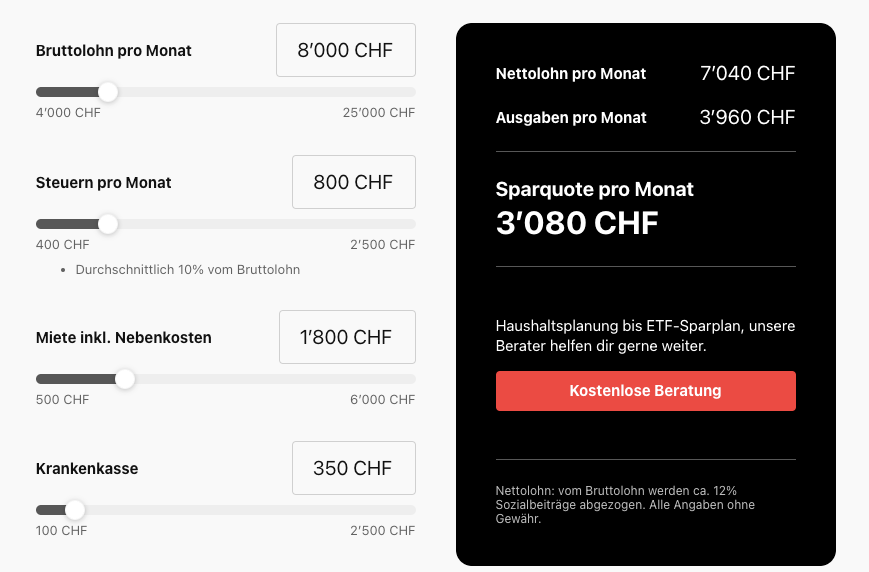

Budget calculator - How much will Switzerland cost me per month?

Emigrating to Switzerland: With our budget calculator, you can realistically estimate your monthly expenses in Switzerland. From rent to health insurance to taxes - the tool calculates your living costs and shows you your savings rate at the end. Ideal for preparing for your emigration to Switzerland.

Do you have any questions?

You want to emigrate to Switzerland? We are here for you. Our consultations are free of charge. You can reach us via the contact form or drop by for a coffee in Zurich.

- Home page

- Deine3a | Share portfolio in Germany | Emigration Switzerland | Emigration agency