How much tax do you pay in Switzerland?

The amount of tax is individual and depends on factors such as salary level, marital status and place of residence. During the first 5 years in Switzerland (with a B permit), the Withholding tax directly from your salary, with different withholding tax rates applying depending on your canton of residence. Under certain circumstances, e.g. if your annual income exceeds CHF 120,000, you may also have to pay tax at source. B permit submit a regular Swiss tax return, which may result in additional tax on the withholding tax. Tip: By making payments into the Pillar 3a you can reduce your tax burden. We will be happy to help you calculate and optimise your taxes: Contact form.

Jim Ince

Expert | Emigration agency Deine3a

Counselling team

Our advisory team and office staff specialise in emigrants from Germany and Austria, and we help people emigrate to Switzerland every day. If you would also like to emigrate to Switzerland, please get in touch using the contact form and get to know our team in Zurich - we look forward to hearing from you! 🤗

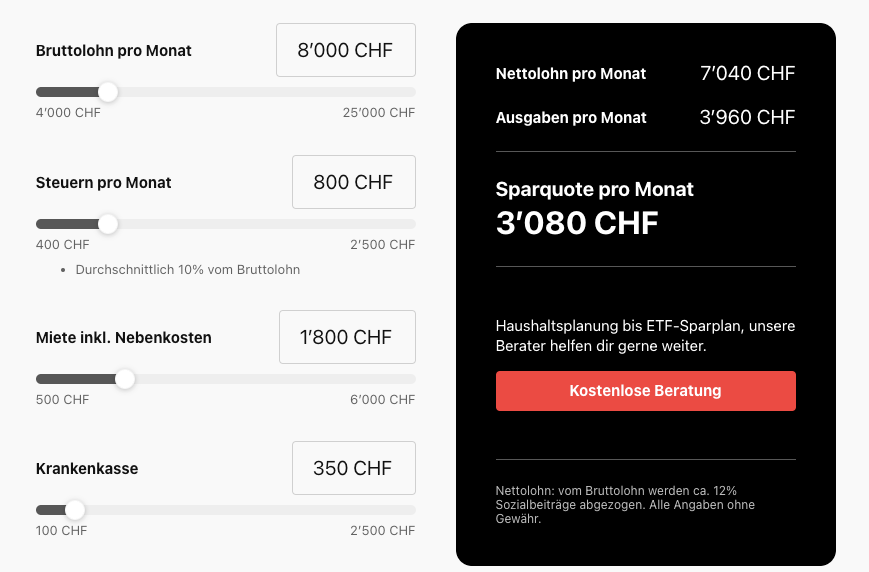

Budget calculator - How much will Switzerland cost me per month?

Emigrating to Switzerland: With our budget calculator, you can realistically estimate your monthly expenses in Switzerland. From rent to health insurance to taxes - the tool calculates your living costs and shows you your savings rate at the end. Ideal for preparing for your emigration to Switzerland.

Do you have any questions?

You want to emigrate to Switzerland? We are here for you. Our consultations are free of charge. You can reach us via the contact form or drop by for a coffee in Zurich.

- Home page

- Deine3a | How much tax do you pay in Switzerland? | Emigration Switzerland | Emigration Agency