Swiss bank account for emigrants

In the following, we explain the requirements you need to fulfil in Switzerland in order to open a bank account on time, pay your rent on time and receive your first salary. When emigrating to Switzerland, a functioning bank account is crucial for smooth financial processes.

Banks in Switzerland

Emigrating to Switzerland: After moving to Switzerland, your Swiss bank account will play a central role, as all financial matters, such as rent and salary, will be handled through it. You can choose between branch banks or online banks. We'll show you which bank best suits your needs and how you can open an account before you emigrate to Switzerland.

Swiss bank account 🇨🇭

Emigrating to Switzerland: In addition to the mountains, cheese and chocolate, it is above all the banking system for which Switzerland is known worldwide.

The banking system in Switzerland is recognised as one of the most stable and secure financial systems in the world. With its long tradition in the banking sector and the country's economic stability, Switzerland attracts customers from all over the world. Swiss banks offer a wide range of account types for different customer needs.

In 2023, there were over 250 licensed banks in Switzerland, including cantonal banks, big banks, regional banks and private banks.

If you are of legal age, you can open a bank account in Switzerland. We recommend that you speak to a customer advisor at a bank in person.

Branch banks vs. online banks

Opening a bank account is an important step for anyone emigrating to Switzerland. Whether for your daily payments or for investments - the right account is crucial for being financially well positioned. However, there are a few special features that you should be aware of.

In Switzerland, you can choose between traditional branch banks and modern online banks. Both options have their advantages and disadvantages - and there are some special features for expatriates to bear in mind.

Branch banks

The best-known branch banks in Switzerland include UBS (which has risen to become the clear number 1 in the Swiss banking centre following the Credit Suisse takeover), Raiffeisen and Zürcher Kantonalbank (ZKB).

These banks offer comprehensive advice and service in their branches, which can be particularly helpful if you need personal support or have questions. However, they often charge higher account fees compared to online banks, and opening an account can be difficult for emigrants who do not yet have a B permit. Without a B residence permit (for long-term residents), many branch banks are unwilling to open an account.

Online banks

Online banks such as Neon or Swissquote, on the other hand, often offer you a quick and uncomplicated account opening process - usually directly via an app or online. These banks usually charge lower fees as they do not operate physical branches. Another advantage for expats: there is an online bank where you can open an account without a B permit. This is particularly interesting for people who are moving to Switzerland but do not yet have all the necessary residence documents. If you would like to know more about this, contact us via our contact form and we will help you find the right way.

Current account

If you're from Germany, you're probably familiar with the term current account. In Switzerland, however, nobody talks about it. Instead, there is the private account (also known as a current account). This is the equivalent of the German current account and is used for daily payment transactions. Your salary is usually paid into this account (which is almost exclusively referred to as a "salary" in Switzerland) and you use it for everyday expenses such as rent, shopping and bills.

There is also a savings account in Switzerland, which often offers a better interest rate. It is suitable for longer-term savings and is not usually used for daily payments. Money transfers from a savings account to a personal account can sometimes be subject to a time limit and there are restrictions on how often you can withdraw money. As the name suggests, this account is really intended for saving, i.e. the money rests here.

Debit card, credit card and prepaid card

In Switzerland, you have various options for making payments with cards. Here is a brief overview of the most important differences.

Debit card

It is linked directly to your private account. When you make a payment with a debit card, the money is immediately deducted from your account. Debit cards are widely used in Switzerland and you can now pay with them almost everywhere.Credit card

Unlike a debit card, a credit card works with a fixed credit limit. This means that payments are not immediately deducted from your account, but are only settled at the end of the month with a total bill. It is a practical way to be financially flexible in the short term, but you should not exceed your limit.Prepaid card

A prepaid card works in a similar way to a credit card, but you have to top it up with credit beforehand. Once the credit has been used up, you cannot make any further payments until you top up the card again. This option is particularly suitable for people who want to keep an eye on their spending or for people who do not (yet) have a credit card.No account without a B permit? Not quite.

Even though many banks require a B permit to open an account, there is a way to open an account without a residence permit - and we know the trick. Our experts at Deine3a will help you find the right account, whether it's a branch bank or an online bank. Get in touch with us via our contact form and we'll arrange an appointment with you to discuss your options. Whether for everyday payments, savings goals or investments - we'll make sure you're in the best possible position.

Investing with Swissquote vs your bank custody account in Germany

Emigrating to Switzerland: If you have already invested in Germany and are wondering what will happen to your bank account once you move to Switzerland, we have the solution for you: Swissquote is a Swiss online bank that gives you access to global financial markets. Many customers of Deine3a have asked how they can manage their investments after the move, and Swissquote offers a flexible and straightforward way to continue investing in securities - even from Switzerland.

You can either keep your bank custody account in Germany or transfer it to Switzerland, depending on your needs. It is important that you bear in mind the tax differences between Germany and Switzerland. Our experts at Deine3a are on hand to help you make the best decisions when it comes to your investments and your bank custody account.

👉 Get in touch for a free consultation: Contact

👉 Budget calculator - How much will Switzerland cost me? Budget calculator

👉 Ready to emigrate? Get the Switzerland checklist: Checklist

👉 You can find more topics relating to your emigration here: Topic overview

👉 Subscribe to our YouTube channel: YouTube

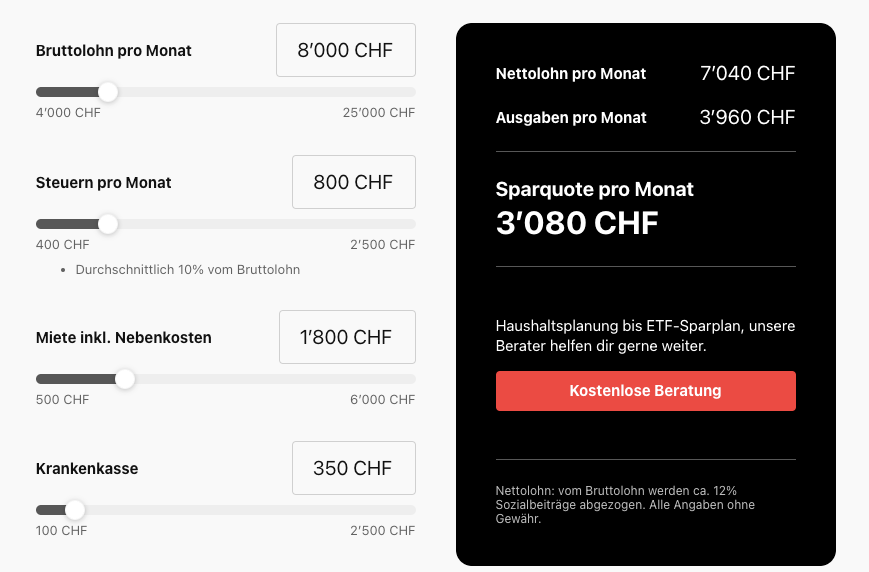

Budget calculator - How much will Switzerland cost me per month?

Emigrating to Switzerland: With our budget calculator, you can realistically estimate your monthly expenses in Switzerland. From rent to health insurance to taxes - the tool calculates your living costs and shows you your savings rate at the end. Ideal for preparing for your emigration to Switzerland.

Counselling team

Our advisory team and office staff specialise in emigrants from Germany and Austria, and we help people emigrate to Switzerland every day. If you would also like to emigrate to Switzerland, please get in touch using the contact form and get to know our team in Zurich - we look forward to hearing from you! 🤗

Do you have any questions?

You want to emigrate to Switzerland? We are here for you. Our consultations are free of charge. You can reach us via the contact form or drop by for a coffee in Zurich.

- Home page

- Deine3a | Swiss bank account for emigrants | Emigration Switzerland | Emigration agency