Gross net payroll accounting Switzerland

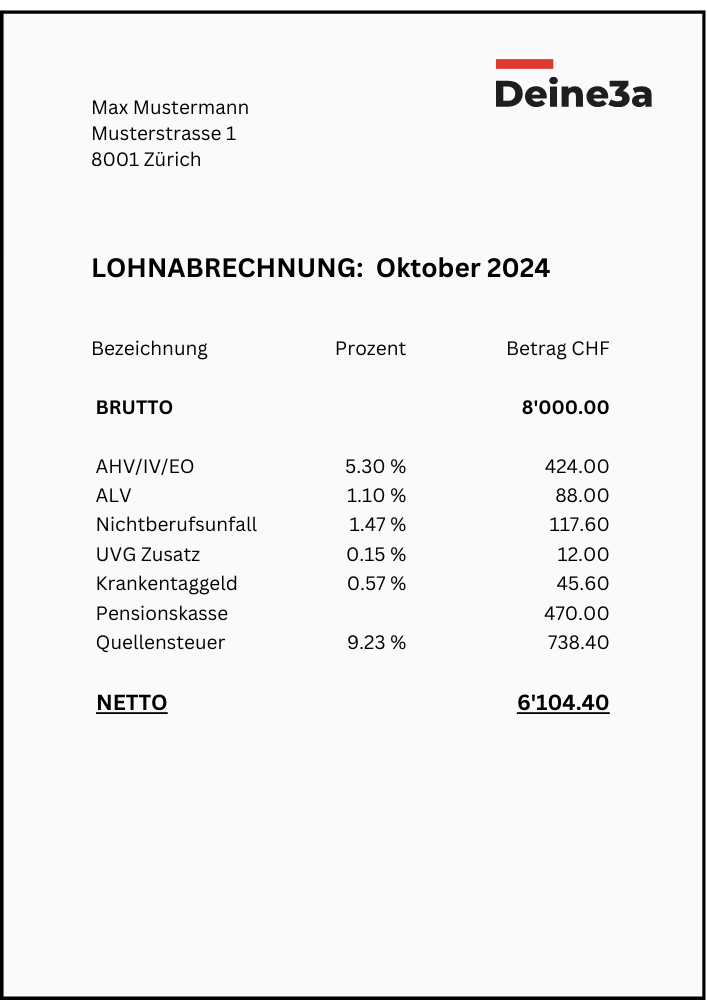

Are you interested in finding out how much your net salary will be in Switzerland? The following numerical example gives you an overview of salary deductions in Switzerland. Important to know: health insurance contributions and the 3rd pillar are not deducted from your salary in Switzerland. If you want to emigrate to Switzerland, it makes sense to know the actual deductions in advance - this way you avoid financial surprises and can plan more effectively.

The Swiss wage sheet - Emigration Switzerland

The time has come: you've made the leap to Switzerland, started your job, completed your first month in your new company - and now you're finally holding your first Swiss payslip in your hands. But what do all these abbreviations mean? And how do these deductions come about?

Don't worry, we at Deine3a will explain this to you clearly. Let's delve together into the mysterious depths of AHV, BVG, ALV and all the other abbreviations that you will soon love - or at least understand better.

Even if all the abbreviations and deductions can seem overwhelming at first, the Swiss salary sheet is actually quite simple and logical once you get the hang of it. Sure, the gross salary looks impressive at first glance - but Switzerland wouldn't be Switzerland if you didn't also make fair provision for old age, illness or unemployment.

Emigrating to Switzerland is easier with good counselling. Sign up for your free consultation.

1 AHV - old-age and survivors' insurance

The AHV is the beating heart of the Swiss social security system, so to speak. Put simply, it ensures that you receive a pension in old age and that your family is financially secure in the event of your death. Every employee and employer in Switzerland pays a certain percentage of their salary into the AHV. You can think of it as the Swiss "pension piggy bank".

2. disability insurance (IV)

Of course, we hope that you will never have to deal with this issue in depth. This is because IV provides financial security if you are no longer able to work due to illness or an accident. IV is closely linked to AHV and is also deducted directly from your salary. Of course, it's better if you never need it, but it's good to know that it's there if things do go wrong.

3 BVG - Occupational pension scheme or pension fund

Here we come to a distinction that is sometimes confusing for newcomers. BVG stands for the "Occupational Pensions Act", which regulates mandatory pension benefits. In Switzerland, however, there is not only the basic BVG pension scheme, but also the pension fund, which often offers supplementary benefits. This means that many employers pay more than the statutory minimum into your pension scheme so that you don't have to live on cheese and dry "Guetsli" (biscuits) in old age.

4 ALV - Unemployment insurance

We hope not, but you may have to use ALV at some point. This offers you protection if you ever lose your job. It pays you part of your previous salary while you look for a new job. In Switzerland, if you work, you pay into ALV. If you become unemployed, you will be given an appointment at the Regional Employment Centre (RAV) in your municipality (or, depending on its size, in another municipality that is part of a network). Your counsellor will support you in your search for a new job.

5. occupational accident and non-occupational accident insurance

In Switzerland, accidents are divided into two categories: those that happen at work (occupational accident insurance) and those that happen in your free time (non-occupational accident insurance). Both types of insurance ensure that you receive medical care in the event of an accident and receive compensation for your salary for as long as you are unable to work. Fair, isn't it?

6. withholding tax

Emigration Switzerland: Withholding tax is a tax that is deducted directly from income. Persons who are resident in Switzerland but do not yet have a permanent residence permit are subject to withholding tax. The same applies to persons who do not have tax residence in Switzerland for their income.

👉 Get in touch for a free consultation: Contact

👉 Budget calculator - How much will Switzerland cost me? Budget calculator

👉 Ready to emigrate? Get the Switzerland checklist: Checklist

👉 You can find more topics relating to your emigration here: Topic overview

👉 Subscribe to our YouTube channel: YouTube

Counselling team

Our advisory team and office staff specialise in emigrants from Germany and Austria, and we help people emigrate to Switzerland every day. If you would also like to emigrate to Switzerland, please get in touch using the contact form and get to know our team in Zurich - we look forward to hearing from you! 🤗

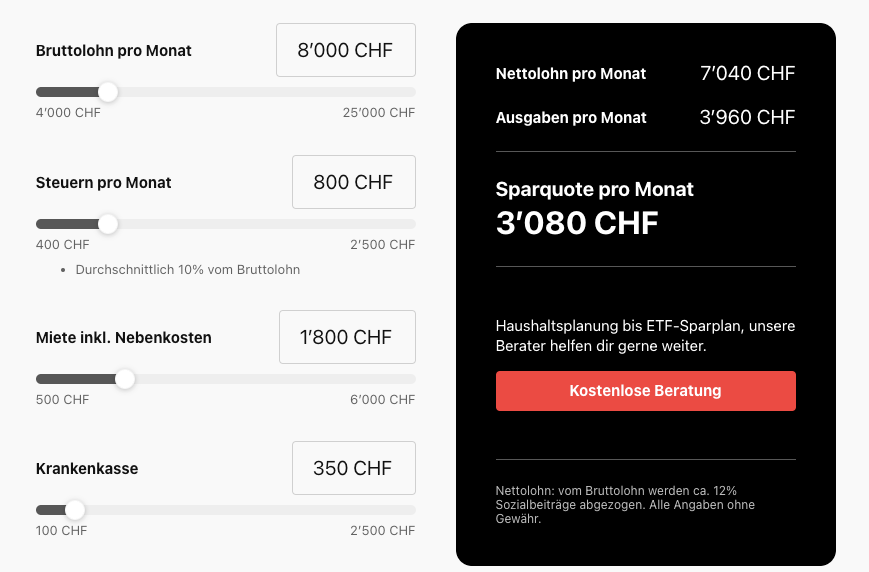

Budget calculator - How much will Switzerland cost me per month?

Emigrating to Switzerland: With our budget calculator, you can realistically estimate your monthly expenses in Switzerland. From rent to health insurance to taxes - the tool calculates your living costs and shows you your savings rate at the end. Ideal for preparing for your emigration to Switzerland.

Do you have any questions?

You want to emigrate to Switzerland? We are here for you. Our consultations are free of charge. You can reach us via the contact form or drop by for a coffee in Zurich.

- Home page

- Deine3a | Gross net payslip Switzerland | Emigration Switzerland | Emigration agency