Refund of value added tax

This section explains how you can get back the VAT you have paid in certain situations. If you have already moved to Switzerland and go shopping in Germany, you can have the German VAT refunded under certain conditions. It is important that you have the export licence stamped correctly and adhere to the deadlines.

Shopping abroad

Do you live in Switzerland and regularly go shopping in Germany? Would you like to know how and where you can get your VAT refunded? We will be happy to answer your questions in a free consultation. After emigrating to Switzerland, it makes sense to make use of this option - especially for larger purchases.

Shopping in Germany 🇩🇪

Let's assume that you visit your friends in Germany after moving to Switzerland. You buy some things there and bring them into Switzerland. The question arises as to what the VAT situation is in this case.

How and where can I get a refund? What conditions must be met in order to get back the VAT paid?

Shopping in Germany is often cheaper. If you go shopping in Germany as a Swiss resident, you have the opportunity to save money and get your VAT back.

You only have to declare your imported goods to Swiss customs if the purchase value exceeds CHF 300 per person. You currently pay 7.7% VAT in Switzerland.

This is how the VAT refund works:

- When you make a purchase, you will receive a receipt, the so-called export licence, at the checkout.

- You can have this export licence stamped at German customs on your return to Switzerland. This only takes a few minutes.

- You bring the stamped export licence to the same shop the next time you make a purchase in Germany and get your VAT back. Either the amount will be deducted from the new purchase amount or you can have the amount paid out in cash.

Some shops use cooperation partners such as Global Blue instead of the export licence. When ordering online, you usually save the VAT directly when purchasing. It should be noted that the retailer is not obliged to offer this option to customers from Switzerland.

Conclusion: The refund of VAT offers you a clear advantage due to your Swiss residence. This means you can often save money when shopping in Germany, which benefits you.

Exceptions

Expenses for your car: regardless of whether you have had damage repaired or bought accessories for your car - a refund is generally excluded in these cases.

👉 Get in touch for a free consultation: Contact

👉 Budget calculator - How much will Switzerland cost me? Budget calculator

👉 Ready to emigrate? Get the Switzerland checklist: Checklist

👉 You can find more topics relating to your emigration here: Topic overview

👉 Subscribe to our YouTube channel: YouTube

Counselling team

Our advisory team and office staff specialise in emigrants from Germany and Austria, and we help people emigrate to Switzerland every day. If you would also like to emigrate to Switzerland, please get in touch using the contact form and get to know our team in Zurich - we look forward to hearing from you! 🤗

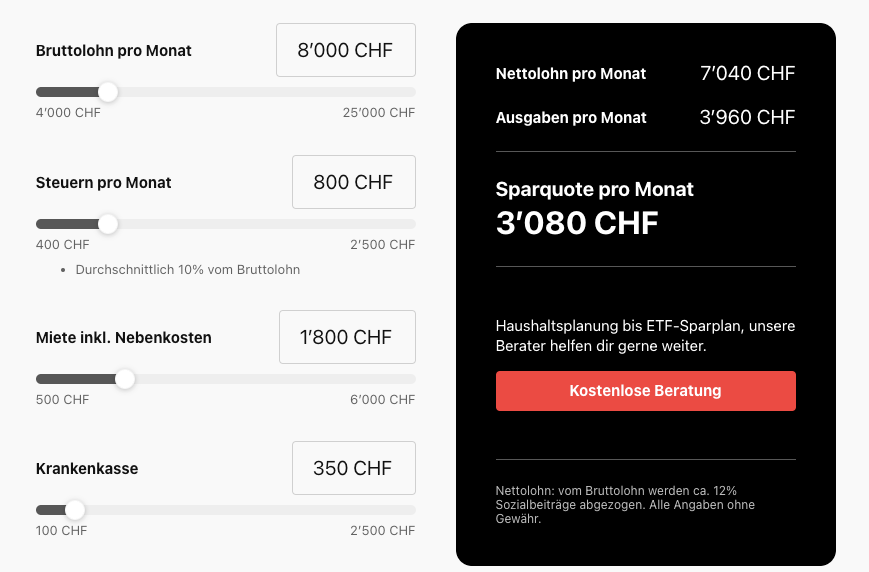

Budget calculator - How much will Switzerland cost me per month?

Emigrating to Switzerland: With our budget calculator, you can realistically estimate your monthly expenses in Switzerland. From rent to health insurance to taxes - the tool calculates your living costs and shows you your savings rate at the end. Ideal for preparing for your emigration to Switzerland.

Do you have any questions?

You want to emigrate to Switzerland? We are here for you. Our consultations are free of charge. You can reach us via the contact form or drop by for a coffee in Zurich.

- Home page

- Your3a | VAT refund | Emigration Switzerland | Emigration agency